Blog

-

SEC Proposed Major Changes to Regulation Crowdfunding (Reg CF)

The SEC has proposed some major changes to Regulation Crowdfunding (Reg CF) that would impact both investors and issuers. These changes could make it much easier to raise capital from the community for Smart Cities start-ups as well as projects delivered through Public-Private Partnerships(P3). At a high level, the SEC's proposed changes to Reg CF would:… -

The Potential of Crowdfunding for Water P3s

The goal of the crowd-financed P3 model is to facilitate involvement of the public, especially local community members, as a major partner in the current P3 model. Investment crowdfunding is a proven model for increasing public engagement and transparency in sophisticated development projects and new ventures. In addition, aligning the interests of the P3 developer,…

-

The Potential of Crowdfunding for Sustainable Infrastructure

Crowdfunding investment for a P3 can help promote sustainable infrastructure projects. Investors who support sustainable infrastructure can vote with their dollars and choose to invest in projects that have demonstrated a commitment to sustainability by being Envision rated. If sustainable infrastructure projects are shown to be preferred by investors over non-sustainable projects, then infrastructure planners…

-

Bridging the Gap Together: A New Model to Modernize U.S. Infrastructure

A great report from the BPC on the need for private investment in public infrastructure that includes a discussion on the use of crowdfunding. Here are the highlights: “An emerging discussion among infrastructure practitioners is the potential of crowdfunding to help pay for projects. Crowdfunding, in which individuals throughout the world can contribute to projects…

-

New Cities Foundation Handbook on Urban Infrastructure Finance Discusses InfraShares and the Benefits of Crowdfunded Investment for P3s

The recently published New Cities Foundation Handbook on Urban Infrastructure discusses the benefits of crowdfunding private investment for public infrastructure projects and the role of the crowdfunding platform: “There are several other advantages associated with using crowdfunded P3 equity. Because the crowdfunding is provided by investors with social as well as financial motivations, they may…

-

Crowdfunding: More Than Just Another Innovative Financing Strategy

A great article by Stanford’s Kate Gasparro addressing the opportunities and challenges of crowdfinancing for public infrastructure projects. Read More

-

The benefits of investing in infrastructure

The benefits of investing in infrastructure In volatile and challenging market conditions, the long duration of infrastructure investments – typically 20 to 50 years, and potentially even longer – can offer greater stability in an uncertain world Portfolio allocations to infrastructure are increasing, with investors enticed by the asset class’ elongated investment horizon. The…

-

Financial Benefits of Using Crowd-financing for a P3

In addition to the social and political benefits of using crowd-financing for a P3, using crowd-financing to raise preferred equity as a portion of the capital stack allows the equity sponsors of a P3 to increase their Return on Equity (ROE) by reducing their common equity contribution. Assuming an interest rate on senior debt of…

-

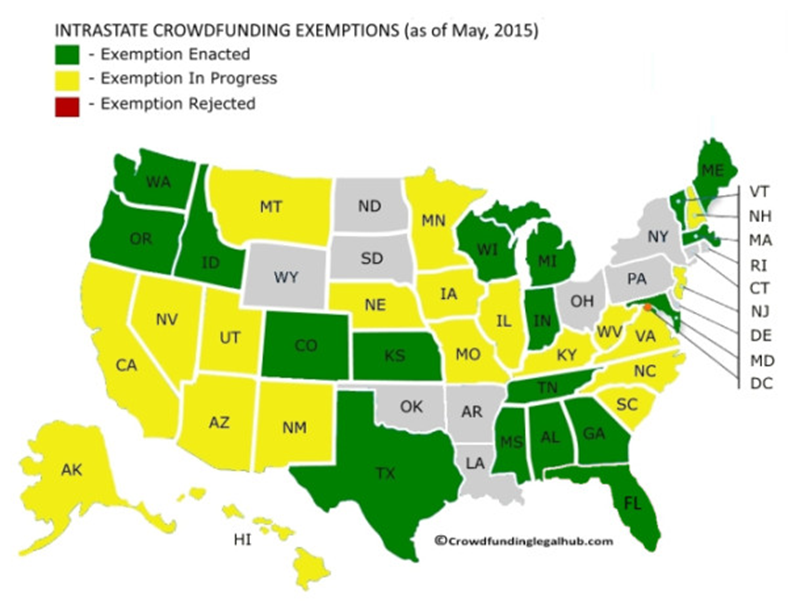

There are several options when crowdfunding investment for infrastructure projects

There has been a lot of hype around the new Title III crowdfunding regulations, but there are several other crowdfunding mechanisms under the JOBS Act already in place that may be better suited for infrastructure projects. Here is a review of the other investment crowdfunding regulations enabled by the JOBS Act and how they fit…

-

Medium-term crowd-financing for accelerating infrastructure projects

Recent changes to securities law (2012 JOBS Act) allows for general solicitation of securities to investors (with certain limitations) through online platforms that offer investment opportunities to individual investors. Public agencies can now partner with a crowd-financing platform (CFP) to solicit medium-term loans from local and state investors who seek safe medium-term investment opportunities as…