Financial Benefits of Using Crowd-financing for a P3

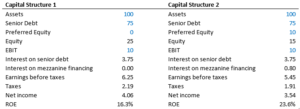

In addition to the social and political benefits of using crowd-financing for a P3, using crowd-financing to raise preferred equity as a portion of the capital stack allows the equity sponsors of a P3 to increase their Return on Equity (ROE) by reducing their common equity contribution. Assuming an interest rate on senior debt of 5% and an interest rate of 8% on preferred equity, the two capital structures outlined in the table below provide materially different ROE. If the project generates earnings before interest and taxes (EBIT) of 10 and is taxed at a rate of35%, the second structure offers a higher return on equity than the structure using only senior debt. The reduction in net income is more than offset by the savings in equity contribution allowing the equity sponsors to deploy equity across a broader portfolio of projects.

In addition to the social and political benefits of using crowd-financing for a P3, using crowd-financing to raise preferred equity as a portion of the capital stack allows the equity sponsors of a P3 to increase their Return on Equity (ROE) by reducing their common equity contribution. Assuming an interest rate on senior debt of 5% and an interest rate of 8% on preferred equity, the two capital structures outlined in the table below provide materially different ROE. If the project generates earnings before interest and taxes (EBIT) of 10 and is taxed at a rate of35%, the second structure offers a higher return on equity than the structure using only senior debt. The reduction in net income is more than offset by the savings in equity contribution allowing the equity sponsors to deploy equity across a broader portfolio of projects.

And because the crowd-financed preferred equity is provided by investors with social (the desire to benefit from improved infrastructure) as well as financial motivations, they may accept a slightly lower rate of return than institutional sources of capital. Also, depending on the method of crowd-financing employed, the securities offered would not be restricted for re-sale, removing liquidity risk and further reducing the rate of return required on the preferred equity. Furthermore, because crowd-financing offers investment to a broad base of retail and small institutional investors, the competition for quality investments puts further downward pressure on the return required. These factors combine to lower the overall cost of capital for the P3 developer, which can be passed along to the public agency sponsor in the form of lower availability payments or to the public with reduced toll/fee structures.