The benefits of investing in infrastructure

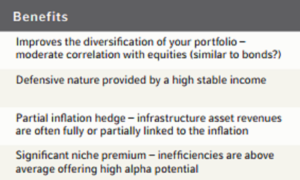

The benefits of investing in infrastructure In volatile and challenging market conditions, the long duration of infrastructure investments – typically 20 to 50 years, and potentially even longer – can offer greater stability in an uncertain world Portfolio allocations to infrastructure are increasing, with investors enticed by the asset class’ elongated investment horizon. The natural life cycle of infrastructure assets are very long, making them an attractive alternative to government bonds in terms of liability matching. A further appeal is revenue streams often have regulated price increase mechanisms that explicitly consider the rate of inflation.

Owning part of one of the world’s first fully electronic toll roads in Melbourne, the Chicago Midway Airport or a local water utility may sound like an unusual investment, but these types of assets continue to gain increasing traction as an attractive avenue for the placement of new capital.

Already firmly established in Australia, Europe and Canada, infrastructure as an asset class is growing rapidly elsewhere. Developing countries are crying out for high levels of investment in the infrastructure they need to support their growing economies and expanding, wealthier populations. At the same time, in the developed world, existing infrastructure is now beginning to falter after long periods of underinvestment.

Upgrading the emerging world’s infrastructure is likely to be one of the themes dominating global investment in the next few years. Emerging market spending is booming as populations are growing and urbanising. This is straining existing infrastructure resources and leading to acute demand for electricity, water and sanitation. Despite recent falls in commodity prices, strong economic growth has granted resource-rich governments’ significant capital to dedicate towards infrastructure investment.